Invest Energy Group

Who We Are

About Us

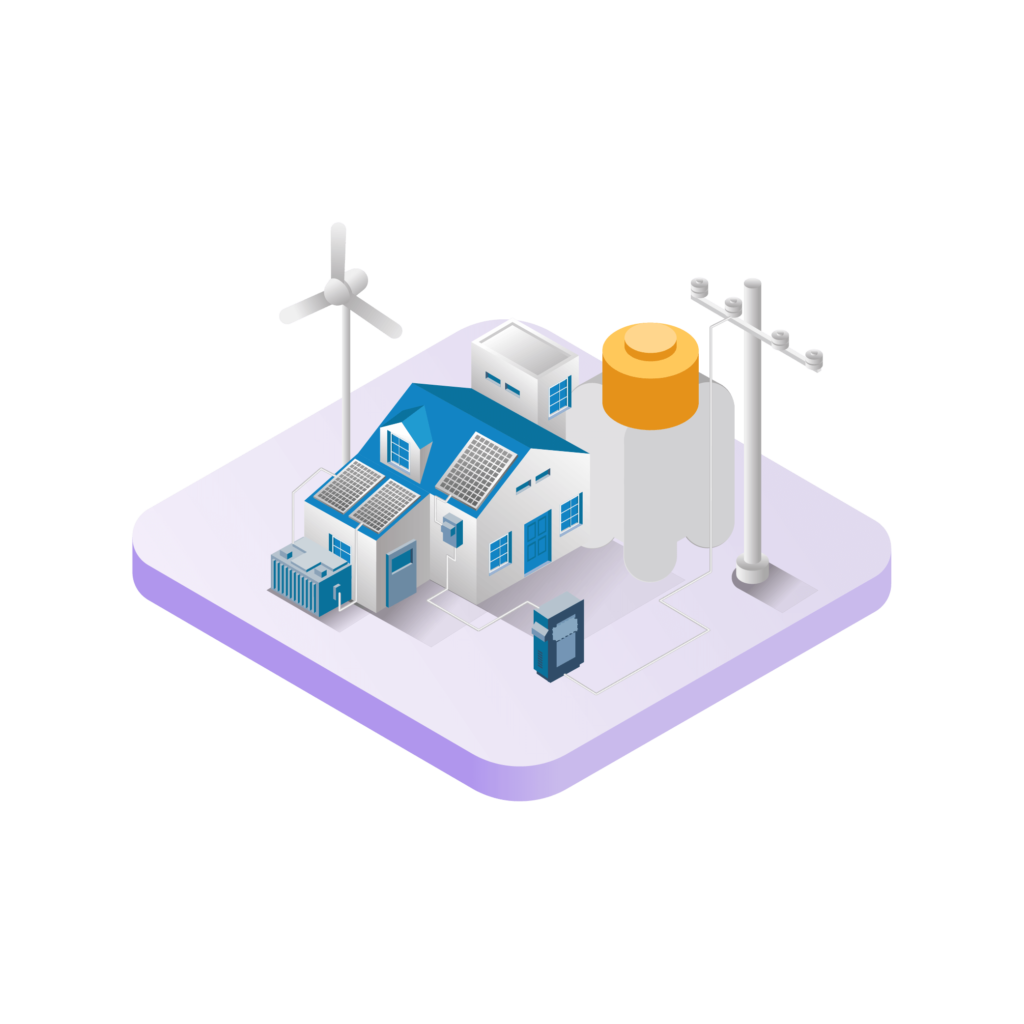

As we grow our asset under management with more than a decade as an asset owner and operator, we focus on investing in sustainable energy sectors of the ASEAN economy. We invest for the long term because building successful, resilient businesses can lead to better returns, stronger communities and economic growth that works for everyone.

We put our own capital to work alongside our partners’ in virtually every transaction, aligning interests and bringing the strengths of our operational expertise, global reach and large-scale capital to bear on everything we do.

Our Businesses

Our Journey So Far

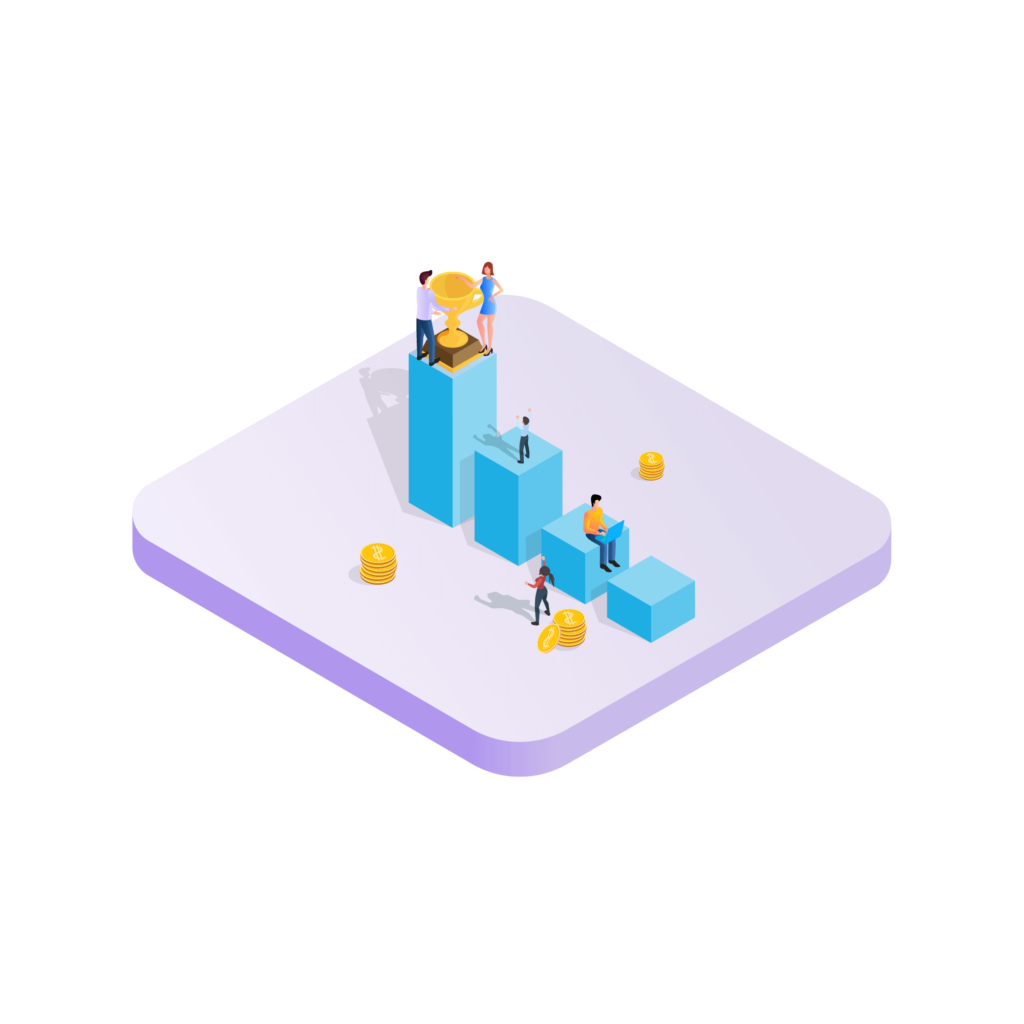

Invest Energy Group's journey with renewable energy

in South East Asia

2011

- Spin off from the 50-year-old KONPRO Engineering Group to be a pure play RE company in Malaysia.

- Secures 2 pioneering biogas plants in Malaysia for the Sabah State Govt.

- Turboden SpA and Mitsui Heavy Industries partnership to develop Waste Heat Recovery in SEA.

2013

2014

- Secures ASEAN’s first Concession based Waste Heat Recovery for SAFRAN S.A.

- Asahi Japan via Etika Malaysia awards 15-year BOOT Co-generation plant.

- Awarded EPCC to develop a Co-generation plant for Cadbury M’sia.

2015

2016

- Complete Series A fund raising with participation from Malaysian state government, family offices and listed companies.

- Wins Best Innovation in Sustainability from EUMCCI Europa Awards for SAFRAN project.

- Portfolio diversification across multiple clean energy sectors increases pipeline deals to 75MW and includes new projects for glove and manufacturing industries.

2017

2019

- Overseas diversification to Vietnam and Cambodia.

- Asset Monetization Exercise to realize investment value is undertaken via a trade sale with multiple return on investment.

- Series A investors exit and reorganization of group is undertaken to reflect new identity as an integrated pure play clean energy Investor and Asset Manager.

- Wins Forst & Sullivan Waste-to-Energy Company of the Year.

- Creates new income streams across a multitude of clean energy sectors to include energy efficiency and green infrastructure for critical industries.

2020

2022

- Secures up to USD100million investment commitment from European ESG Energy Efficiency Fund via a joint-venture fund.

- Completes transformation into a Private Equity Investor, Developer and Asset Manager with its Invest Energy Fund 1 for up to USD150million to invest across SEA.

- Completes first capital deployment with its maiden investment in Thailand acquiring one of the largest biogas plants in SEA.